The automotive industry continues to be a hotbed of innovation, with activity driven by safety concerns, regulations, and autonomous vehicles, and the growing importance of technologies such as sensors and ADAS driver monitoring systems. In the last three years alone, there have been over 1.2 million patents filed and granted in the automotive industry, according to GlobalData’s report on Innovation in Automotive: Resistive braking motors.

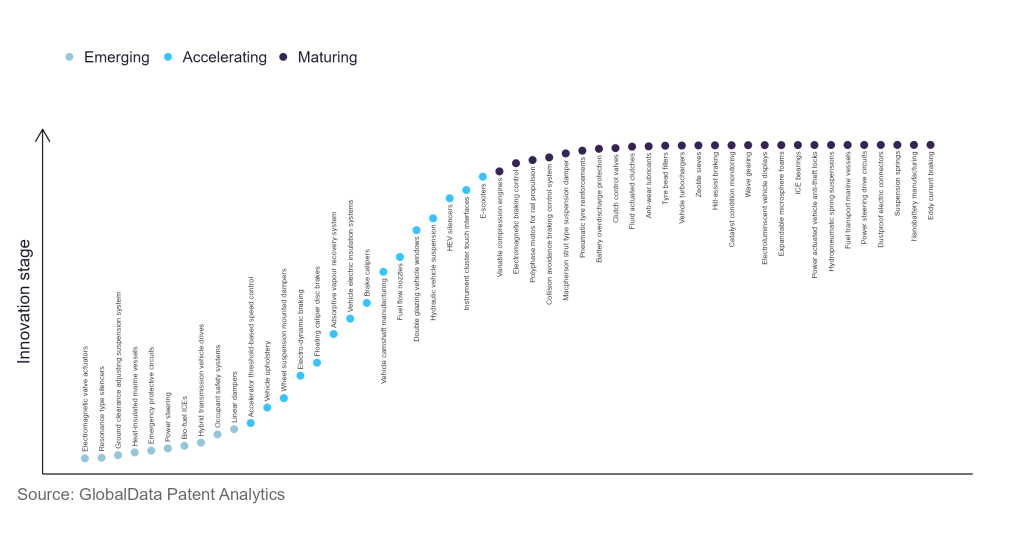

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

290+ innovations will shape the automotive industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the automotive industry using innovation intensity models built on over 619,000 patents, there are 290+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, resilient spoke wheels, auto-transmission lubrication circuits, and ignition switching engines are disruptive technologies that are in the early stages of application and should be tracked closely. Engine purge actuators, electro-dynamic braking, and adsorptive vapour recovery system estimation are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are collision avoidance braking control system and direct injection type engines, which are now well established in the industry.

Innovation S-curve for the automotive industry

Resistive braking motors is a key innovation area in automotive

The purpose of a braking resistor is to quickly stop or slow down the mechanical system by producing a braking torque. Braking resistors have features such as resistance, average braking power and higher reliability. The braking resistors with smaller ohmic values are designed to enable motors to stop faster and dissipate more heat.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 50+ companies, spanning technology vendors, established automotive companies, and up-and-coming start-ups engaged in the development and application of resistive braking motors.

Key players in resistive braking motors – a disruptive innovation in the automotive industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to resistive braking motors

Source: GlobalData Patent Analytics

Toyota Motor is a key player in the resistive braking motors innovation area. Toyota’s braking resistors require less service and provide higher reliability by reducing wear on friction-based braking components and allowing regeneration that lowers net energy consumption. The resistive braking motors may also be used on railcars with multiple units, light rail vehicles, electric trams, and electric and hybrid electric automobiles. Robert Bosch Stiftung, Hitachi, Mitsubishi Electric, and Siemens are few other key players.

To further understand the key themes and technologies disrupting the automotive industry, access GlobalData’s latest thematic research report on Automotive.