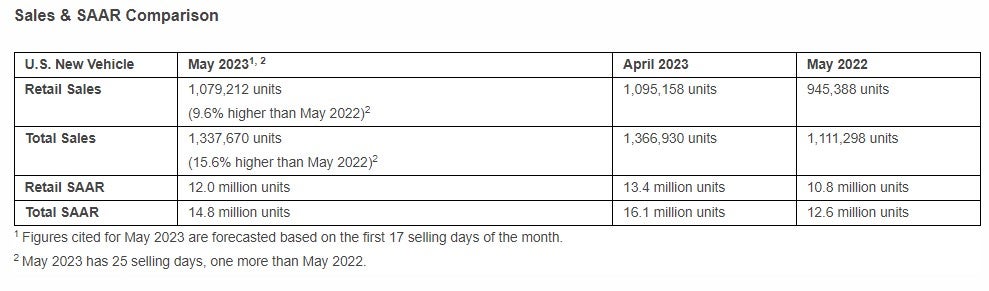

Total US new light vehicle sales for May 2023, including retail and non-retail transactions, are projected by JD Power and LMC Automotive (a GlobalData company) to reach 1,337,700 units, a 15.6% increase from May 2022.

May 2023 has 25 selling days, one more than May 2022. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 20.4% from 2022.

Thomas King, president of the data and analytics division at JD Power said the positive performance is complemented by a projected 0.7% increase in average transaction prices. “As a result, it is anticipated that consumers will spend nearly $47 billion on the purchase of new vehicles in May, showcasing a significant 13% growth from a year ago,” he said.

King also points out that retail inventory is healthier now. “Retail inventory levels in May are expected to finish at approximately 1.3 million units, remaining consistent with April’s level. However, this represents a substantial increase of 48% compared with May 2022.

“The improvement in vehicle availability has led to decreased dealer margins and increased manufacturer incentive spending in that same period. However, both metrics are relatively stable when compared with the previous month. The performance of the retail market continues to demonstrate robust demand for vehicles, augmented by consumers who have delayed purchases due to low inventory.

“Manufacturers continue to leverage increased vehicle production to allocate more vehicles to fleet customers. Fleet sales are projected to increase 50% from May 2022.”

New vehicle transaction prices continue to rise, with the average price reaching a May record of $45,838 – a 0.7% increase from a year ago. “The record transaction prices means that consumers are on track to spend nearly $46.9 billion on new vehicles this month—the second highest for the month of May and 13% higher than May 2022,” says King.

However, the improved supply of vehicles vs. a year ago has resulted in a decline in dealer profits – albeit well above pre-pandemic levels. The total retailer profit per unit—which includes grosses and finance and insurance income—is expected to reach $3,732. While this is 25.8% lower than a year ago, it is still more than double the amount in May 2019. The primary reason for the decline in profit is that fewer vehicles are being sold for prices higher than the manufacturer’s suggested retail price (MSRP). This month, only 31% of new vehicles are projected to be sold above MSRP, which is down from a high of 49% in July 2022.

Elizabeth Krear, vice president, electric vehicle practice at JD Power pointed out that among the tax credit eligibility rules on newly purchased EVs, there are requirements for critical battery minerals and components – and those requirements have significantly reduced the number of vehicles that qualify for the full credit, creating downward pressure on the affordability of EVs. She adds: “When EVs are leased, however, none of these restrictions apply because the vehicles are technically classified as commercial. This makes the lessor eligible for the $7,500 credit, giving them the option to pass that credit along to customers. Accordingly, lease affordability has surpassed purchase affordability in the J.D. Power EV Index, suggesting that EV lease volumes will surge during the next several months.”

Also, she says new data shows that public charging station reliability has improved for the first time in two years. However, she adds: “This improvement is not exactly cause for celebration, though. Through the end of Q1 2023, 20.8% of EV drivers using public charging stations experienced charging failures or equipment malfunctions that left them unable to charge their vehicles. What’s more, overall customer satisfaction with Level 2 charging—which accounts for 71% of all public charging—declined 11 points during Q1 2023. Customer satisfaction with faster Level 3 charging has improved, but far fewer customers currently have access to these charging points.”

Some details:

- The average new-vehicle retail transaction price in May is expected to reach $45,838, a 0.7% increase from May 2022. The previous high for any month—$47,362—was set in December 2022.

- Average incentive spending per unit in May is expected to reach $1,788, up from $951 in May 2022. Spending as a percentage of the average MSRP is expected to increase to 3.7%, up 1.6 percentage points from May 2022.

- Average incentive spending per unit on trucks/SUVs in May is expected to be $1,698, up $721 from a year ago, while the average spending on cars is expected to be $1,421, up $567 from a year ago.

- Retail buyers are on pace to spend $46.9 billion on new vehicles, up $5.5 billion from May 2022.

- Truck/SUVs are on pace to account for 79.1% of new vehicle retail sales in May.

- Fleet sales are expected to total 258,500 units in May, up 49.6% from May 2022 on a selling day adjusted basis. Fleet volume is expected to account for 19% of total light vehicle sales, up from 15% a year ago.

- Average interest rates for new vehicle loans are expected to increase to 7.0%, 206 basis points higher than a year ago.