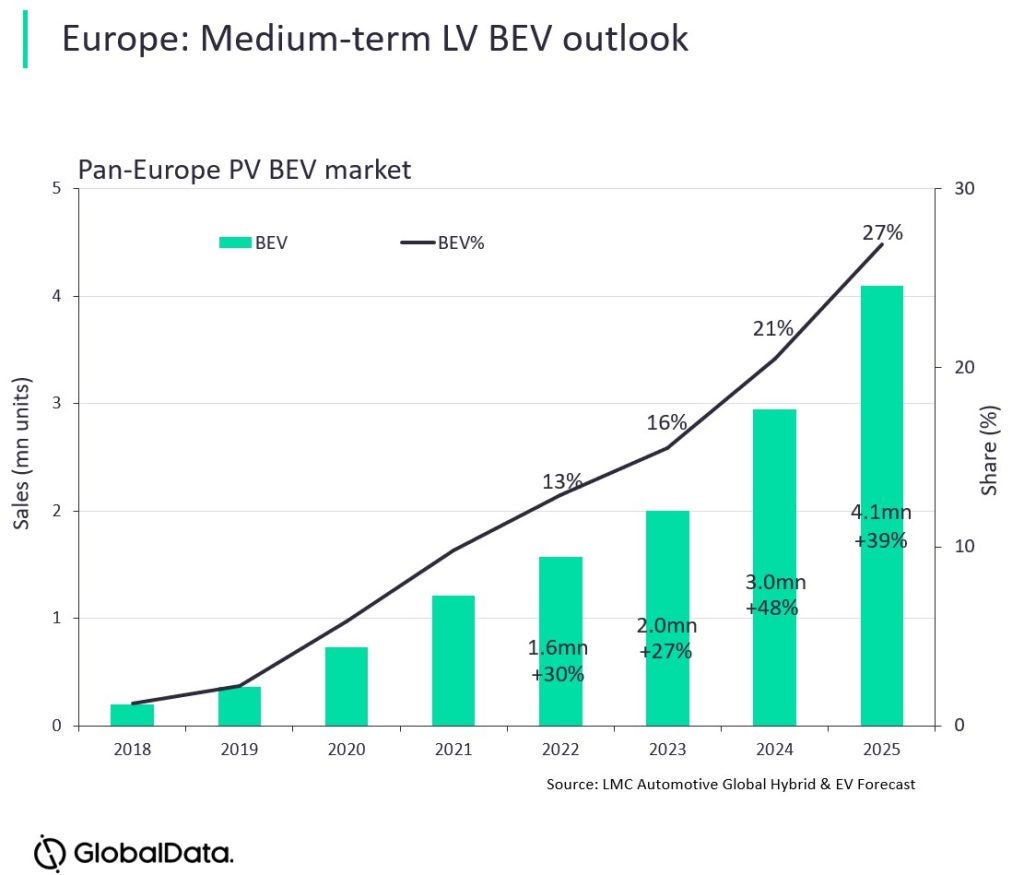

All new cars and vans sold in the EU from 2035 must effectively be zero-emission vehicles (ZEV), except for e-fuels and low-volume automakers. However, given that only 12% of new Light Vehicles (LVs) sold in the EU last year were ZEV and with the variation between those markets being wide, the question arises of whether the proposal is realistically attainable without any significant effect on overall vehicle sales.

The answer to this question depends on many external and industry factors, involving pretty much every aspect of the automotive value chain. So, given the broad scope of this question, this Analyst Briefing seeks to only cover some of the key factors which could impact the transition.

If recent history is anything to go by, the EU could have confidence in Sweden achieving its proposal with minimal or no topline disruption. For example, with 12 years to go, almost a third (31%) of new LVs registered last year in Sweden were battery electric vehicles (BEVs), compared with only 18% in 2021 (a year-on-year increase of 67% in volume terms). However, on the other hand, Italy, the third largest LV market in the EU witnessed BEV sales (and growth) fall from 67k units (5%) in 2021 to 49k units (4%) last year. This high degree of variation between member states highlights how the proposal will be more difficult for some markets to achieve – without a topline impact – than others.

That said, an extensive number of car brands (mainly Premium) have already explicitly stated that they will go all-electric as early as 2027 in some cases, although for some there are caveats which depend on market conditions. Furthermore, several countries within the EU have proposed to only allow ZEVs to be sold from 2030 onwards. As a result, if there is to be market volatility, perhaps we should expect it as early as 2030 and not just in 2035.

Among other factors, Italy and other similar markets face two relatable problems as to why the full transition to BEVs may be more challenging than for others: vehicle segmentation and the price of BEVs. Around 60% of all new cars purchased in Italy last year were either A or B-segment vehicles, whereas the European average for these two vehicle segments combined was 39%. However, BEVs tend to be bigger (for assorted reasons); roughly 70% of BEVs sold last year in the EU were C segment or above.

OEMs have favoured developing battery electric vehicle technology on larger and more Premium models. This is unsurprising given the higher costs associated with BEVs. For example, developing a competitive and profitable sub €15-20k small BEV car at the moment is nigh on impossible, at least for Western OEMs. This raises the question of whether A-segment cars will disappear in the future, given the shift to BEVs. After all, some legacy OEMs have already said they are re-strategising away from concentrating on higher volume and are moving towards higher profits and a focus on selling more Premium and high-end vehicles, which tend to be larger in size. If OEMs do shift away from selling smaller vehicles, then markets such as Italy could experience a detrimental effect on overall vehicle sales.

But while this strategy makes sense for legacy OEMs, it also leaves the door open for new entrants to penetrate the market and gain a foothold (we are already seeing more competitors enter the market). Furthermore, assuming that OEMs can make smaller BEVs profitably in the future, then from a consumer standpoint they make sense, given that they tend to be cheaper and produce fewer emissions over their life cycle versus other vehicle segments. Bearing this in mind and considering how policymakers may tax BEVs in the future – for example, a life cycle emission tax and/or a weight tax (Norway has recently introduced a weight tax, which includes BEVs) – would mean smaller BEVs become even cheaper and more desirable, suggesting that there may be a place for Sub-Compact BEVs after all.

One of the main disadvantages of BEVs is that (overall) they remain more expensive than their ICE counterparts, particularly in the case of non-Premium vehicles and Light Commercial Vehicles (LCVs). However, it could be argued that the total cost of ownership for BEVs is lower. As a result, price parity remains a big discussion point and questions remain about whether the price of BEVs in certain segments will ever be competitive. If not, there is likely to be a substantial impact on topline sales, given that most buyers are price sensitive.

In recent years, the supply chain crisis has led to constrained output and allowed OEMs to increase prices and maximise profits, although, as supply chain disruption has eased, we are already seeing market forces push the price of new vehicles down, including BEVs. However, last year, rising component and battery raw material prices, particularly lithium, resulted in the average lithium-ion battery pack costs rising, reversing recent trends. Considering the high share of total vehicle cost that the battery accounts for in a BEV, if this trend were to continue price parity between BEV and ICE vehicles may never be achieved.

However, while we expect lithium supply to be tight, we do expect the price of lithium-ion cells (and battery packs) to fall over the forecast horizon. OEMs are diversifying their battery chemistry mix for various reasons, including mitigating risk and cost. In addition, with the optimisation of battery packs, high energy/power density cells may not always be a necessity, enabling cheaper technology, such as LFP and potentially even sodium-ion to be developed at a wider scale, helping ease supply constraints and drive down costs. That said, if recent history is anything to go by then there could be a degree of volatility in raw material prices over the forecast horizon which could impact pricing and availability.

Given the opportunity that BEVs present, the technical and cost advantages of some Chinese OEMs have allowed them to gain a foothold in the EU market. While many of these new entrants have positioned themselves in the Premium space for now, their cost advantage, the market opportunity and small car vacuum, should allow Chinese brands to fill the gaps, helping drive down the price gap between BEVs and ICE.

That said, Western OEMs are aggressively developing their BEV capabilities in a variety of ways, such as streamlining their manufacturing process, developing next-generation scalable all-electric platforms, as well as other improvements in vehicle, battery, and powertrain technology, which should help maximise their competitiveness. Overall, we expect this competition to help drive down prices for electric vehicles before 2035, although we recognise that the timing of price parity with ICE will differ depending on status and vehicle segmentation.

So, considering all this and taking into account that Chinese BEV makers have a technical lead amounting to several years over Western brands in terms of battery material sourcing, cost reduction and onboard technology. One outcome for the EU is that car demand will continue to be fulfilled (with no topline impact) by a mix of largely domestic products in the medium and upper segments and non-domestic products, from China (and India) in the more affordable segments, those having been abandoned as non-profitable by legacy carmakers. Alternatively, battery cost reduction will move fast enough among Western OEMs such that the dream of affordable BEVs across all market segments for their brands comes true. If neither of these scenarios (or a mix of them) play out, and things like charging infrastructure do not improve, then some European markets will be exposed to potentially significant falls in topline sales in the 2030s.

David Leah, Senior Analyst, Powertrain Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center