The automotive industry continues to be a hotbed of innovation, with activity driven by government regulations and environmentally conscious consumers, and growing importance of technologies such as high-efficiency particulate air (HEPA) filters and ultra-low particulate air (ULPA) filters. In the last three years alone, there have been over 1.2 million patents filed and granted in the automotive industry, according to GlobalData’s report on Environmental sustainability in Automotive: Zeolites for exhaust filtering.

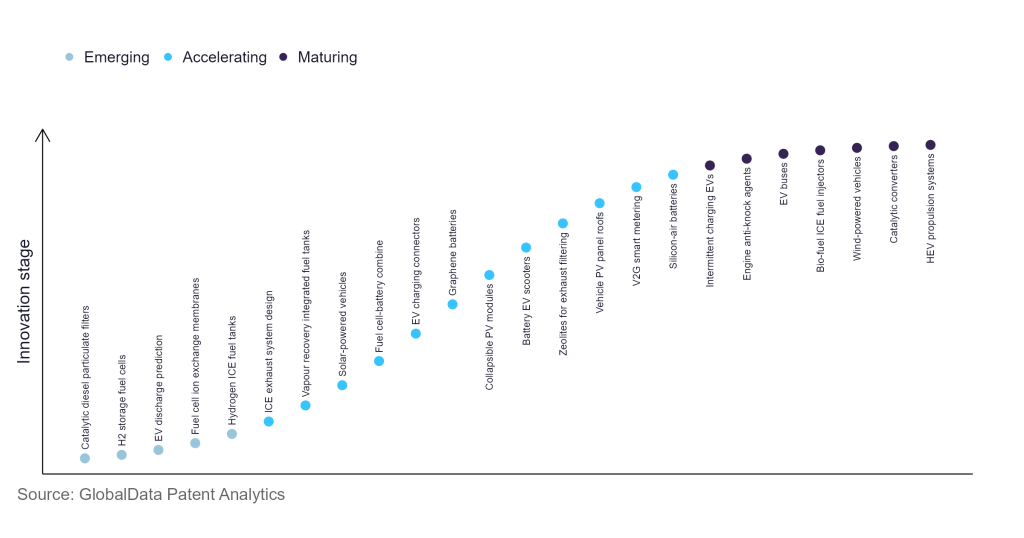

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

290+ innovations will shape the automotive industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the automotive industry using innovation intensity models built on over 619,000 patents, there are 290+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, EV discharge prediction, fuel cell ion exchange membranes, and hydrogen ICE fuel tanks are disruptive technologies that are in the early stages of application and should be tracked closely. V2G smart metering, silicon-air batteries, and zeolites for exhaust filtering are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are HEV propulsion systems and wind-powered vehicles, which are now well established in the industry.

Innovation S-curve for environmental sustainability in the automotive industry

Zeolites for exhaust filtering is a key innovation area in environmental sustainability

Zeolites are a filtration material used for hydrocarbon trapping, selective catalytic reduction of nitrogen oxides (NOx) with NH3 (NH3-SCR), and hydrocarbon NOx reduction applications. Zeolites capture these harmful pollutants that are not taken care of by the catalytic converter. They have a natural porosity because of their crystalline structure, which gives them the ability to trap particles in their pores, called cages.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 50 companies, spanning technology vendors, established automotive companies, and up-and-coming start-ups engaged in the development and application of zeolites for exhaust filtering.

Key players in zeolites for exhaust filtering – a disruptive innovation in the automotive industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to zeolites for exhaust filtering

Source: GlobalData Patent Analytics

Johnson Matthey is a key player in the zeolites for exhaust filtering innovation area with 695 patents filed. The company engages in the production of zeolites for the selective catalytic reduction method of exhaust filtering. Johnson Matthey’s zeolites have excellent and varied filtration properties in addition to adsorption ability, which provides an advantage over costly, energy-intensive alternative separation methods such as distillation, absorption, and thermally driven separation processes. BASF, Toyota, and Aisin are some of the other key players.

To further understand how environmental sustainability is disrupting the automotive industry, access GlobalData’s latest thematic research report on Automotive.